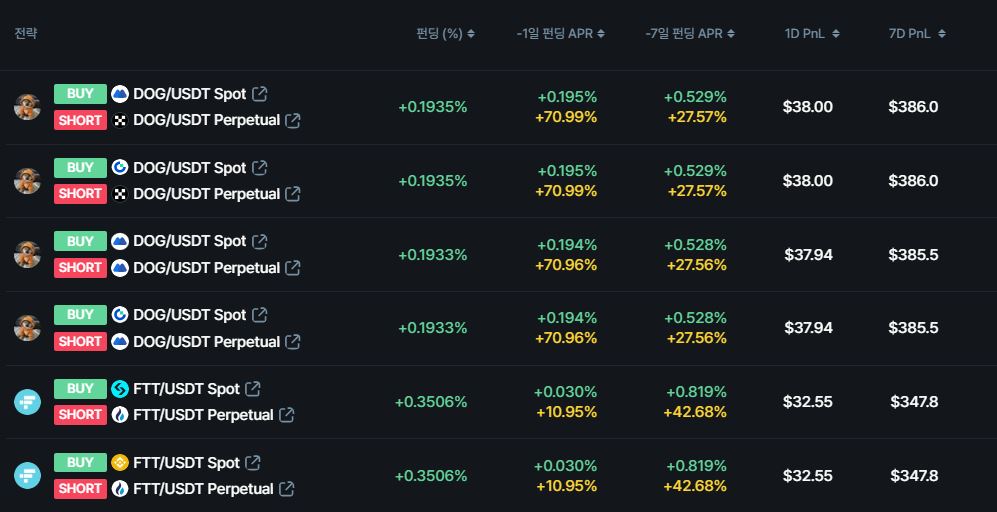

Recent research conducted by Berenberg Investment Bank indicates a decline in Coinbase's cryptocurrency trading volumes for the U.S. market during the third quarter. The study reveals that Coinbase experienced a sequential 16.8% drop and a notable 51% reduction compared to the previous year. This information comes ahead of Coinbase's official announcement of its third-quarter results scheduled for November 2.

The bank expressed concerns over Coinbase's customer base potentially decreasing, attributing this to increasing competition in the cryptosphere, especially in segments experiencing lower trading volumes.

Mark Palmer, a leading analyst, shared Berenberg's perspective on Coinbase Global. The main apprehension wasn't necessarily Coinbase's operational efficiency in upcoming quarters. Instead, the focus shifted to the increasing regulatory challenges and legal battles Coinbase is confronting in the U.S. As regulatory scrutiny over cryptocurrency tightens, these challenges might intensify.

While political factors might curtail the effectiveness of Coinbase's lobbying, recent news articles highlighting entities like Hamas using cryptocurrencies might further complicate the legal standing of these digital currencies.

Interestingly, even with the decline in trading volumes and mounting regulatory pressures, Coinbase's share prices remain resilient. The current valuation is on par with figures from late 2021, during the pinnacle of the crypto surge. The study also highlighted that Coinbase's stock increased by an impressive 112% this year. In comparison, Bitcoin's value rose by 73%, and the Nasdaq stock index saw a 28.9% increase.

Despite these developments, Berenberg maintains a neutral stance on Coinbase's stock, affirming its hold rating and setting a $39.9 price target. On a closing note, Coinbase's shares were valued at $77.40 as of the last report.

1

1