CryptoQuant, a leading data analytics company, has projected substantial growth in Bitcoin's value, asserting that its worth could rise to a staggering $900 billion. Additionally, they predict the overall cryptocurrency market could witness an increase of $1 trillion if the bitcoin spot exchange-traded funds (ETFs) get the green light.

The past couple of years, particularly between 2020 and 2021, marked the initial phase of institutional players integrating Bitcoin into their financial portfolios. The anticipated next step, as laid out by CryptoQuant, would see these establishments granting their clientele direct access to Bitcoin via spot ETFs.

In a comparison with the Grayscale Bitcoin Trust (GBTC), which is recognized as the globe's premier cryptocurrency fund with assets valued at around $16.7 billion, the prospective influx from spot ETFs would surpass the funds GBTC accumulated during its peak cycle. It's noteworthy that Grayscale's umbrella organization is the Digital Currency Group, which also oversees CoinDesk.

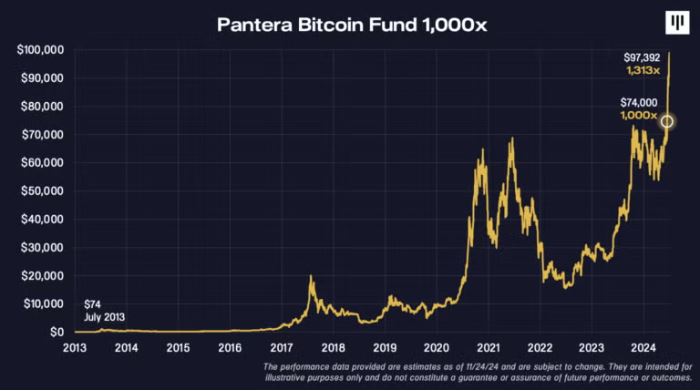

By the estimates of CryptoQuant, if those entities currently vying to list bitcoin ETFs allocate just 1% of their Assets Under Management (AUM) towards these ETFs, a formidable $155 billion might be injected into the bitcoin market. This estimation approximates to nearly one-third of Bitcoin's present market worth. If such a situation were to unfold, analysts speculate that Bitcoin's value could oscillate between $50,000 and $73,000.

Historical data suggests that with every bull run, Bitcoin's market value has amplified by a factor of 3-5 times more than its recognized capitalization. CryptoQuant further elucidated that this could signify a $3-$5 market capitalization increase for every new dollar infused into the Bitcoin ecosystem.

A recent erroneous article by Cointelegraph claiming the approval of a spot bitcoin ETF led to Bitcoin's value briefly soaring to $30,000. Some market watchers believe that such a bullish uptrend might deter speculative downward trading for a while. Markus Thielen, a chief figure at Matrixport, shared that even though the news was incorrect, Bitcoin might still observe an upward trend, given the looming potential of spot ETF approval.

One noteworthy development is the diminishing GBTC discount, which is at its smallest in almost two years. Bitcoin presently dominates over half of the $1.13 trillion total cryptocurrency market value, which initially breached the $1 trillion benchmark in January 2021.

0

0