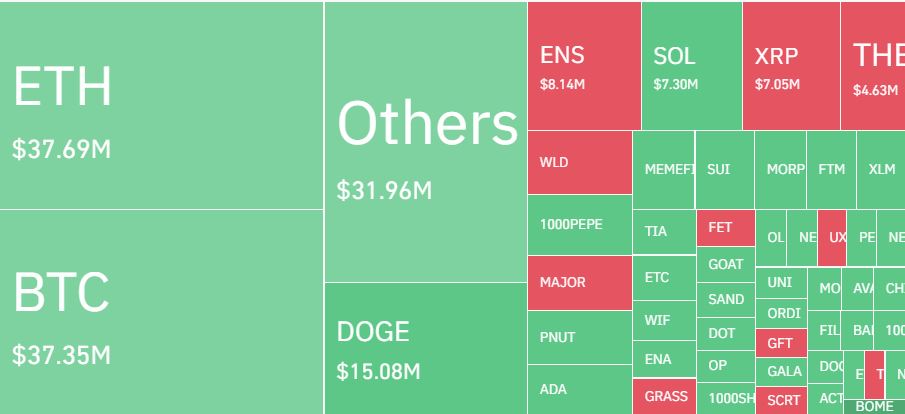

The cryptocurrency world witnessed a seismic shift recently, as Bitcoin's price made a remarkable upward leap. This unexpected rise resulted in substantial losses for traders who predicted a drop in value. In just one day, traders faced losses exceeding $178 million due to these misguided predictions.

As the numbers came rolling in, reports indicated that futures tied to Bitcoin constituted almost half of the staggering $400 million in total cryptocurrency liquidations on Monday. On the other hand, futures associated with Ether, another major cryptocurrency, only accounted for $50 million in liquidations for both long and short stances.

For those unfamiliar with the term, liquidation in the cryptocurrency sphere happens when a trading platform has to shut down a trader's leveraged stance. This closure arises from the trader's inability to maintain the necessary margin requirements, resulting in a loss of their initial stake. Simply put, it's the consequence of a trader not having enough funds to support their trade.

Several prominent cryptocurrency exchanges, including Binance, Huobi, and OKX, faced liquidations amounting to $50 million each, hinting at the vast amount of leverage at play on these platforms. Notably, the heftiest single liquidation order emerged on Binance, carrying a value tag of $10 million.

As for Bitcoin, its price jumped by a notable 12%, touching a peak of $35,200, only to experience a slight dip the following morning. Analysts believe this surge was propelled by a unique combination of reduced volume and a spike in demand, leading to a rapid increase in market capitalization.

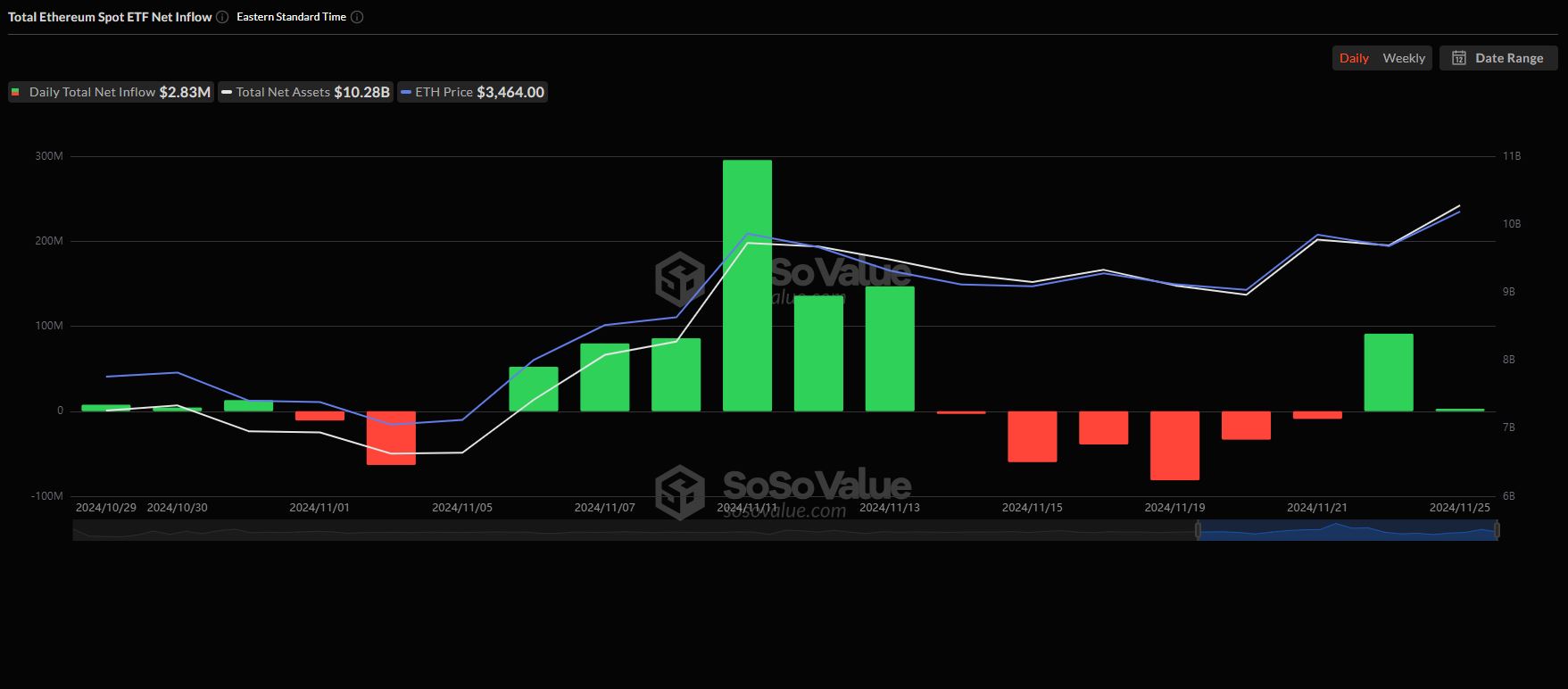

Insiders from the cryptocurrency sector and market analysts think that this price jump might be linked to Blackrock's application for a spot bitcoin ETF. This application is currently under review by the U.S. Securities and Exchange Commission (SEC). The potential approval of such an ETF could be the rejuvenating factor the crypto market has been yearning for after experiencing a stagnant phase for months.

Lucy Hu, a top trader at Metalpha, mentioned earlier that the increasing number of ETF submissions by major corporations and the potential approval of a Bitcoin ETF could be the catalysts that steer the cryptocurrency market towards a vibrant bull phase.

0

0