링크가 복사되었습니다.

링크가 복사되었습니다.

3

3

0

0

1

1

922

922

2018년 11월 AMM (https://coinmarketcap.com/alexandria/glossary/automated-market-maker-amm) 형태로 론칭된 유니스왑 프로토콜 거버넌스 토큰으로 UNI를 이더리움 메인넷에서 출시 (https://www.tokenpost.kr/article-42547)

- 이더리움 주소 : 0x1f9840a85d5af5bf1d1762f925bdaddc4201f984

- UNI 출시로 이더리움 Gas 비용이 500 Gwei까지 상승 (https://www.tokenpost.kr/article-42561)

- UNI 토큰의 이체 수수료가 ETH 네트워크 전체 수수료의 18.57%를 차지하며, GAS 소모가 가장 높은 컨트랙트로 부상 (https://www.tokenpost.kr/article-42604)

참여 풀

- WBTC-ETH 풀 유동성은 17일 이후 900% 급증 (https://www.tokenpost.kr/article-42736)

Genesis UNI 배분

Initial release:

- 15% to the community airdrop.

- 2% to liquidity mining (over the course of 3 months).

Vesting over 4 years:

- 43% to the governance treasury (explained in more detail below).

- 21.51% to team members and future employees.

- 17.80% to investors (i.e. early VCs who funded Uniswap).

- 0.69% to advisors.

UNI 공급 계획

UNI 거버넌스

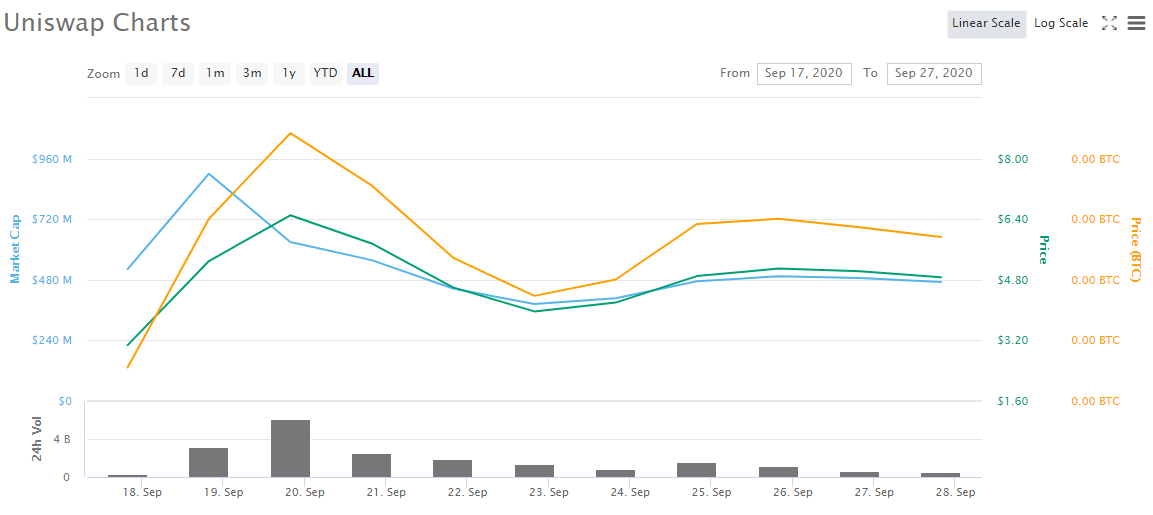

UNI 가격 추이

참고 :

- https://insights.glassnode.com/uni-token-is-uniswap-really-decentralized/

- https://defiprime.com/uniswap-explained

- https://eng.ambcrypto.com/uniswap-explained-a-super-detailed-guide-on-uniswap-by-nowpayments/

- https://blog.coinmarketcap.com/2020/09/23/stablecoin-stamp-of-approval-inside-unis-distribution-a-data-perspective-by-intotheblock/

- https://coinmarketcap.com/currencies/uniswap/

댓글 1개

raonbit

2020.10.06 01:17:46

Uniiswap Liquidity : https://www.tokenpost.kr/forum/free/33471