링크가 복사되었습니다.

링크가 복사되었습니다.

댓글 1개

raonbit

2021.10.23 08:46:18

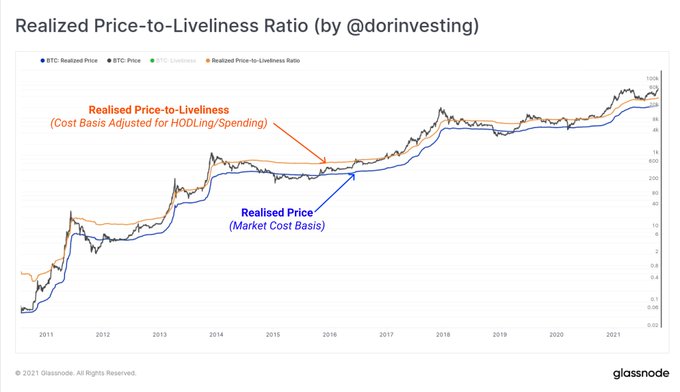

The Realized Price-to-Liveliness Ratio (RPLR) is a metric which compares the spending / HODLing behavior of long-term investors (Liveliness) with the ‘fair value’ of bitcoin (Realized Price).

The Realized Price is often considered the aggregate cost basis for the market, reflecting the average price at which the coin supply was last spent on-chain. Liveliness is a unit-less metric calculated as the ratio between the cumulative sum of coins days destroyed, and the cumulative sum of coin-days created. Liveliness trades between a value of 0 (no coin ever spent) and 1 (all coins spent instantaneously).

As such, the Realized Price-to-Liveliness Ratio applies a weighting factor to the Realized Price in line with the degree of HODLing taking place in the network. Large scale HODLing acts to constrain supply, increasing the estimated 'fair value', and vice-versa.

Where more HODLing is taking place, more coin-days are created, Liveliness trends towards zero, and RPLR fair value is estimated higher.

Where less HODLing is taking place, more coin-days are destroyed, Liveliness trends towards unity, and RPLR fair value is estimated lower.

2021.10.23 08:45:59